Profitable

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

Simple solutions from home, fast. Instant money in your account and flexible loan terms

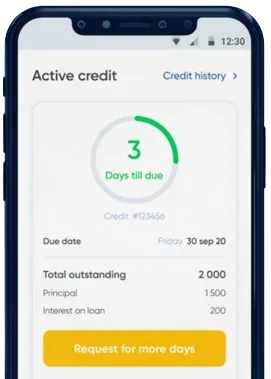

Fill out an application form directly in our app.

Stand by for our decision, usually delivered in just 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Salary advance loans have become increasingly popular in Kenya as a means to address short-term financial needs. These loans, also known as payday loans, are typically offered by financial institutions and lending companies to individuals who are in need of immediate cash before their next paycheck.

Unlike traditional bank loans, salary advance loans are easier to access, require minimal documentation, and have a quicker approval process. This makes them a convenient option for those facing urgent financial constraints.

There are several benefits to consider when opting for a salary advance loan in Kenya. One of the primary advantages is the quick disbursal of funds, which can help individuals meet their urgent financial obligations without delay. Additionally, the loan requirements are usually less stringent compared to traditional loans, making them accessible to a broader range of individuals.

These benefits make salary advance loans an attractive option for those seeking immediate financial assistance in Kenya.

Salary advance loans can be particularly useful in emergencies or unexpected situations where individuals require immediate access to funds. These loans can help cover expenses such as medical bills, car repairs, or other unforeseen costs that cannot be postponed until the next paycheck.

Moreover, salary advance loans can also be used to avoid costly late payment fees on bills or to bridge temporary gaps in income. By providing a short-term financial solution, these loans can help individuals navigate through challenging financial situations with ease.

Before applying for a salary advance loan in Kenya, it is essential to carefully consider the terms and conditions of the loan, including interest rates, repayment terms, and any additional fees. It is crucial to borrow only what is necessary and to ensure that the loan can be repaid on time to avoid falling into a cycle of debt.

In conclusion, salary advance loans in Kenya offer a practical solution for individuals facing short-term financial challenges. With quick approval processes, minimal documentation requirements, and flexible repayment options, these loans provide a reliable source of immediate cash when needed. By understanding the benefits and considerations associated with salary advance loans, individuals can make informed decisions to manage their financial needs effectively.

A salary advance loan is a short-term loan provided to an individual based on their expected salary. It is usually offered by financial institutions or online lenders to help individuals cover unexpected expenses before their next payday.

In Kenya, individuals can apply for a salary advance loan online or through a financial institution. The loan amount is typically a percentage of the individual's monthly salary and is repaid with interest when the individual receives their next paycheck.

To qualify for a salary advance loan in Kenya, individuals usually need to provide proof of employment, a copy of their ID, and a recent paystub. Some lenders may also require a good credit score or a guarantor.

Some benefits of taking a salary advance loan include quick access to cash, no collateral required, and the ability to cover unexpected expenses. Additionally, salary advance loans can help individuals avoid late payment fees or overdraft charges.

Drawbacks of taking a salary advance loan include high-interest rates, potential impact on credit score if not repaid on time, and the risk of getting trapped in a cycle of debt if used frequently.

Some lenders in Kenya may still provide a salary advance loan to individuals with a bad credit score, but the interest rates may be higher. It is important to shop around and compare offers from different lenders to find the best option.